How does buying a house affect taxes

There is a range of tax deductions homebuyers or homeowners can use to lower their tax bill. Learn which tax breaks apply to your and what tax forms to use.

Read more

There is a range of tax deductions homebuyers or homeowners can use to lower their tax bill. Learn which tax breaks apply to your and what tax forms to use.

Read more

See how to buy a house without a real estate agent; weigh what you’ll miss, when DIY works, and the essential steps and safeguards to navigate the purchase.

Read more

Every real estate transaction comes with fees, no matter how you pay. Learn what is included in closing costs, when they’re due, and what they all mean.

Read more

Explore pre approval, verified approval, and conditional approval stages, what lenders verify at each, and how faster approvals strengthen home bids today.

Read more

What is an escrow account? Learn how it works, and why it helps protect buyers, sellers, and lenders. Discover the types, rules, and their real estate benefits.

Read more

Use our house inspections checklist to prepare for your home inspection, spot red flags, estimate costs, and negotiate repairs before you close on a home.

Read more

Learn how title and settlement services help you close on a home, from title searches to insurance, escrow, and signing, plus what to expect at every step.

Read more

Two ways that refinancing can benefit homeowners going through a divorce

Read more

Your utility bills can eat up a large chunk of your monthly budget, but there are a number of ways you can cut costs. Check out our tips for saving....

Read more

Considering an out-of-state move? Don’t overlook these cities with lower costs of living and affordable homebuying options.

Read more

Low-income homeowners who were previously denied a mortgage refinance may now qualify through RefiNow™. You may save up to $3k/yr by lowering your monthly costs.

Read more

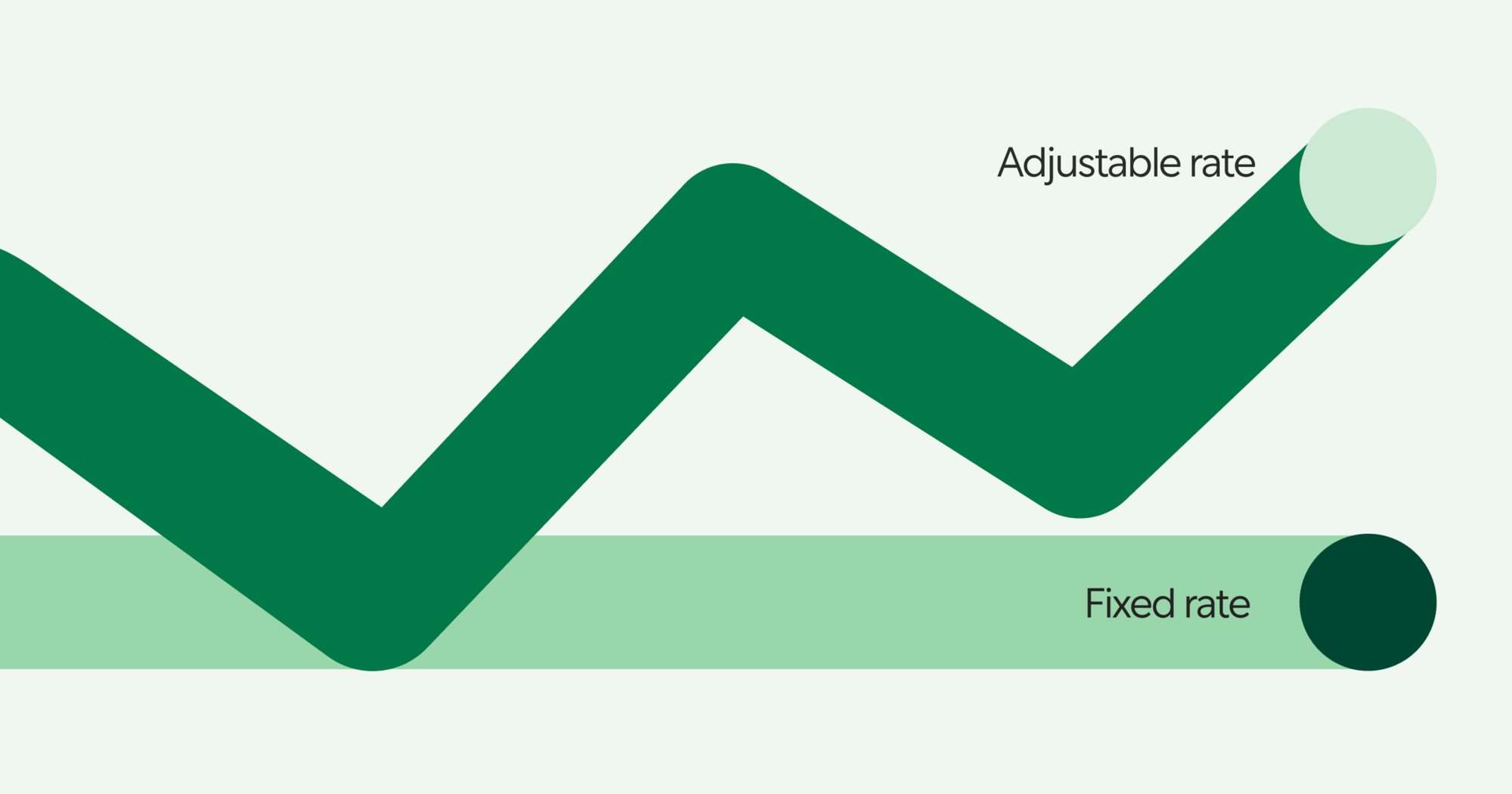

Trying to decide between a fixed-rate mortgage and an adjustable-rate mortgage? Here’s the difference, and how to figure out which home loan is right for you.

Read more

Thinking about buying a second home? Learn key rules, lender requirements, and expert tips to qualify, secure financing, and buy your dream second home.

Read more

Many people are involved in the process of buying a home. You can expect to talk to everyone from a real estate agent to a loan consultant, and more.

Read more

Use our home appraisal checklist to maximize your property’s value, whether buying, selling, or refinancing. Prepare for success with expert tips and guidance.

Read more

If you’re applying for a mortgage or refinancing, you’ll need to “lock” your rate during the loan process. Here’s a breakdown of what exactly that means.

Read more

Learn how to navigate buying a new construction home—from the home loan process, through assembling your team, and how you can avoid predatory lenders.

Read more

Real estate PMI, or private mortgage insurance, is required for low down payment mortgage loans. Learn about how real estate PMI can impact your mortgage costs.

Read more

Here’s how you can put down roots and buy a house without having to give up your dreams of traveling the world.

Read more

Better Mortgage's Head of Capital Markets explains what he wishes he had known about ARMs when he bought his first home.

Read more

Need something else? You can find more info in our FAQ